Chipotle’s Financial Performance

Chipotle Mexican Grill, known for its fresh ingredients and customizable burritos, has experienced significant financial growth in recent years. The company’s strong brand recognition, focus on quality, and expansion strategies have contributed to its impressive performance. This section will delve into Chipotle’s financial performance, analyzing its revenue growth, profitability, and comparisons with its key competitors.

Revenue Growth

Chipotle’s revenue has steadily increased over the past five years. The company’s revenue growth is driven by a combination of factors, including:

- New restaurant openings: Chipotle has been aggressively expanding its footprint, opening new restaurants across the United States and internationally. This expansion strategy has contributed significantly to revenue growth.

- Increased same-store sales: Chipotle has also seen a consistent increase in same-store sales, indicating that existing restaurants are performing well and attracting more customers.

- Menu innovation: Chipotle has introduced new menu items and promotions, such as its “Lifestyle Bowls” and “Real Food, Real Good” campaign, which have attracted new customers and boosted sales.

- Digital ordering and delivery: The company has invested heavily in digital ordering and delivery platforms, which have become increasingly popular among consumers. This has helped to drive revenue growth and reach a wider customer base.

Profitability and Margins

Chipotle’s profitability has also been strong, with consistent growth in gross profit, operating profit, and net income.

- Gross Profit: Chipotle’s gross profit margin has remained consistently high, reflecting its ability to control costs and maintain high-quality ingredients. This margin is calculated by subtracting the cost of goods sold from revenue.

- Operating Profit: Chipotle’s operating profit margin has also been impressive, indicating efficient operations and effective cost management. This margin is calculated by subtracting operating expenses from gross profit.

- Net Income: Chipotle’s net income has grown steadily, reflecting its strong profitability and ability to generate returns for shareholders. This income is calculated by subtracting all expenses, including taxes, from revenue.

Comparison to Competitors

Chipotle’s financial performance compares favorably to its key competitors in the fast-casual restaurant industry. The company has consistently outperformed its peers in terms of revenue growth, profitability, and stock performance.

- Higher Revenue Growth: Chipotle has consistently experienced higher revenue growth compared to competitors like Panera Bread and Subway, highlighting its strong brand appeal and expansion strategies.

- Stronger Profitability: Chipotle’s profitability metrics, including gross profit margin and operating profit margin, are generally higher than those of its competitors. This reflects its focus on cost control and operational efficiency.

- Superior Stock Performance: Chipotle’s stock has outperformed its competitors in recent years, reflecting investor confidence in the company’s growth potential and financial performance.

Debt Levels and Cash Flow

Chipotle maintains a relatively low level of debt, indicating a healthy financial position. The company’s strong cash flow generation allows it to invest in growth initiatives, such as new restaurant openings and technology upgrades, without relying heavily on external financing.

- Debt-to-Equity Ratio: Chipotle’s debt-to-equity ratio is relatively low, suggesting a conservative approach to debt financing. This ratio compares a company’s total debt to its shareholder equity.

- Free Cash Flow: Chipotle generates strong free cash flow, which is the cash flow available to the company after accounting for capital expenditures. This cash flow is used for debt repayment, dividends, and investments in growth initiatives.

Chipotle’s Operational Performance: Chipotle Stock

Chipotle’s operational performance is a crucial aspect of its success, reflecting its ability to execute its strategy and deliver a consistent customer experience. This section delves into key operational aspects, analyzing Chipotle’s menu innovation, marketing strategies, customer experience, and labor management practices.

Menu Innovation Strategy and Impact

Chipotle’s menu innovation strategy focuses on offering a limited but high-quality menu with fresh ingredients. The company regularly introduces new menu items and variations, keeping its offerings exciting and catering to evolving consumer preferences. This approach has proven successful in driving customer satisfaction and sales.

For instance, the introduction of the “Lifestyle Bowls” catering to specific dietary needs, such as the “Vegan Bowl” and “Paleo Bowl,” has attracted a broader customer base and contributed to sales growth. Additionally, Chipotle’s commitment to using fresh, high-quality ingredients, such as non-GMO corn and antibiotic-free meat, resonates with health-conscious consumers, enhancing customer loyalty and brand perception.

Effectiveness of Marketing and Advertising Campaigns

Chipotle has employed a diverse range of marketing and advertising campaigns to reach its target audience. The company’s focus on digital marketing, including social media and online advertising, has been particularly effective in engaging younger consumers.

Chipotle’s “Food with Integrity” campaign, highlighting its commitment to sustainable and ethical sourcing practices, has resonated with environmentally conscious consumers. The company’s use of humor and relatable content in its advertising campaigns has also been successful in creating a memorable brand experience.

Customer Experience and Service

Chipotle strives to provide a fast and efficient dining experience, emphasizing fresh, customizable meals prepared in front of customers. The company’s “Chipotle Real” campaign, highlighting its commitment to transparency and real ingredients, has contributed to building trust with customers.

However, Chipotle has faced challenges in maintaining consistency in customer service, particularly during peak hours. Long lines and wait times can sometimes detract from the overall customer experience. The company is actively addressing these issues through investments in technology and employee training to improve operational efficiency and customer service.

Labor Costs and Employee Retention

Chipotle’s labor costs are a significant expense, representing a significant portion of its operating costs. The company has faced challenges in retaining employees, particularly in a competitive labor market.

To address this, Chipotle has implemented various initiatives, including wage increases and employee benefits, to improve employee retention and reduce labor costs. The company’s focus on employee development and training programs aims to create a positive work environment and attract and retain skilled employees.

Chipotle’s Industry Landscape and Future Outlook

Chipotle operates within the highly competitive fast-casual restaurant industry, characterized by evolving consumer preferences, fierce competition, and the constant need for innovation. Understanding the industry’s dynamics and future trends is crucial for assessing Chipotle’s long-term prospects.

Competitive Landscape and Key Trends

The fast-casual restaurant industry is a dynamic and competitive landscape, characterized by several key trends that influence Chipotle’s strategy and performance. These trends include:

- Increased Competition: The industry has witnessed a surge in new entrants and established players expanding their offerings, leading to intense competition for market share. This competition manifests in various forms, such as price wars, menu innovation, and aggressive marketing campaigns.

- Focus on Health and Wellness: Consumers are increasingly prioritizing healthy and sustainable food options, driving demand for restaurants that offer fresh, high-quality ingredients and transparent sourcing practices. Chipotle has successfully positioned itself as a leader in this space, emphasizing its use of real, whole ingredients and its commitment to sustainable agriculture.

- Technological Advancements: The industry is embracing digital technologies to enhance customer experience, streamline operations, and drive growth. This includes online ordering, mobile payment options, loyalty programs, and data-driven marketing strategies. Chipotle has been at the forefront of these advancements, investing heavily in its digital infrastructure and expanding its online presence.

- Labor Shortages: The fast-casual industry, like many others, faces challenges related to labor shortages and rising labor costs. Attracting and retaining skilled employees is crucial for maintaining operational efficiency and customer service quality.

Impact of Economic Conditions and Consumer Spending

Economic conditions and consumer spending patterns significantly impact the fast-casual restaurant industry. When the economy is strong, consumers tend to have more disposable income, leading to increased spending on dining out. Conversely, during economic downturns, consumers may cut back on discretionary spending, including restaurant meals.

Chipotle’s focus on value and its commitment to fresh, high-quality ingredients have helped it navigate economic fluctuations more effectively than some competitors.

Growth Opportunities for Chipotle

Despite the challenges, Chipotle has several potential growth opportunities in the future. These opportunities include:

- New Menu Items: Expanding its menu with innovative and appealing offerings can attract new customers and increase sales. This includes introducing new protein options, seasonal specials, and limited-time offerings.

- Geographic Expansion: Expanding its footprint into new markets can tap into untapped customer bases and drive revenue growth. This includes opening new restaurants in both domestic and international locations.

- Digital Initiatives: Continuing to invest in its digital infrastructure and expanding its online ordering and delivery capabilities can enhance customer convenience and drive sales growth. This includes optimizing its mobile app, partnering with delivery platforms, and leveraging data analytics to personalize customer experiences.

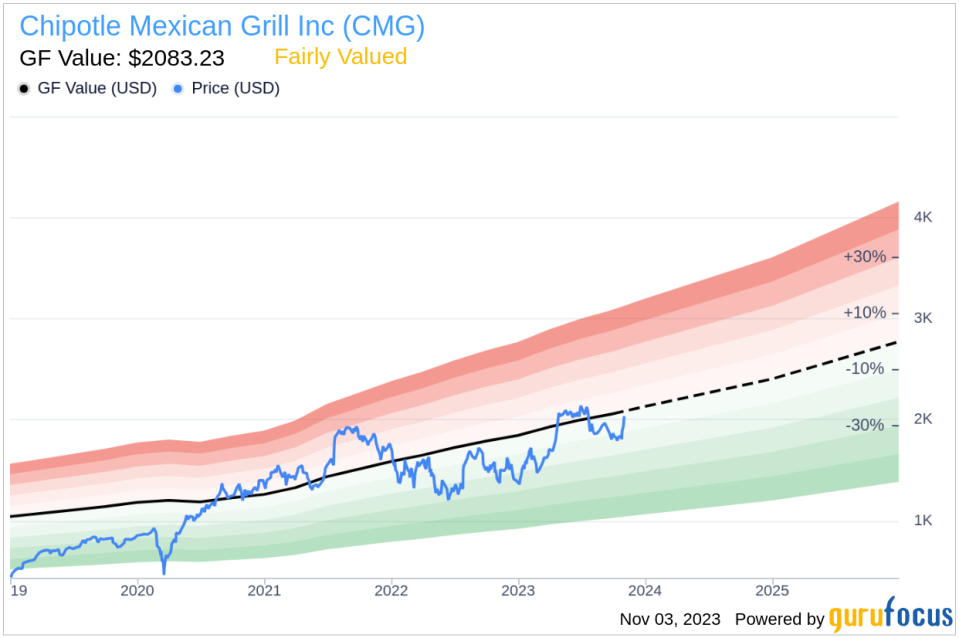

Long-Term Growth Prospects, Chipotle stock

Chipotle’s long-term growth prospects are promising, given its strong brand recognition, commitment to fresh ingredients, and focus on digital innovation. However, the company faces ongoing challenges from competition, economic volatility, and labor market dynamics. To maintain its competitive edge, Chipotle needs to continue innovating its menu, expanding its reach, and leveraging technology to enhance customer experience.

Chipotle stock, known for its focus on fresh ingredients and customizable burritos, has been a popular choice for investors. While Chipotle’s growth trajectory is impressive, it’s also worth considering the potential of other fast-casual giants like sbux stock , which boasts a global presence and a loyal customer base.

Both companies have the potential to benefit from the ongoing shift towards convenient and high-quality dining experiences, but ultimately, investors should carefully evaluate their individual investment goals and risk tolerance when deciding between Chipotle and Starbucks.

Chipotle stock has been on a rollercoaster ride in recent years, but investors are watching closely to see if the company can regain its momentum. One leader who has proven his ability to navigate challenging times is laxman narasimhan , who successfully steered Starbucks through a period of significant change.

His experience in driving growth and customer loyalty could be valuable insights for Chipotle as it seeks to regain its position as a leading fast-casual restaurant chain.